There’s A further chance due to the fact these apps normally quickly withdraw the personal loan total and any costs from your checking account in your payday: When you don’t have plenty of cash as part of your account and don’t have overdraft defense, you may end up getting overdraft charges from the financial institution. In some cases, your lender could close your account if overdrafts happen a whole lot.

Before you decide to make an application for funding through a funds-borrowing application, contemplate the advantages and drawbacks to determine if it makes sense to move ahead.

Why it is possible to believe in Forbes Advisor: Our editors are devoted to bringing you impartial rankings and information. Our editorial material is not influenced by advertisers.

All fees are subject matter to vary without warning and will differ department to branch. These rates are from financial institutions, thrifts, and credit score unions, several of whom have paid for just a backlink to their own personal Website the place yow will discover additional info. Those having a paid out url are our Advertisers.

We also deemed app attributes for example usage of lender accounts, debit cards and revenue management equipment. We also checked rankings and read customer assessments on Google Engage in as well as the App Keep to comprehend the consumer working experience.

Having said that, some shoppers are dissatisfied with their progress amounts or point out issues getting support from customer care or canceling their subscriptions.

Among the several immediate financial loan apps, a few stick out in the crowd. Brigit, Dave, and Latest are popular alternatives thanks to their person-pleasant interfaces to borrow income promptly right after signing up with your smartphone.

It’s not uncommon for credit history unions to examine your credit history. Nevertheless, a reduced rating doesn’t routinely imply a denial, given that the credit history union may well approve you determined by the energy of your respective reliable banking history.

Even though these apps don't cost interest, they are not completely devoid of Price. It really is fantastic to be familiar with typical Expense structures that some apps run underneath:

Our top-rated lenders will not be the top fit for all borrowers. To find out more, study our complete personalized financial loans methodology.

As well as its borrowing feature, Cash Application has a immediate deposit services that get more info allows you to receive your earnings from a employer up to 2 times before the Formal payday. Cash App stands out for its investing System and its Remarkable attribute of delivering cost-free Worldwide transfers to Cash App customers in both The us and the uk.

7+ ranking with 401k testimonials on the Application Retail outlet and Google Engage in. We advocate Brigit despite the higher membership fee because they demand no concealed late costs or curiosity costs, and it comes with a credit score builder that can transform your credit score history.

Membership payment Empower’s cash progress support doesn’t transform interest or late service fees, but If you'd like your hard earned money fast, you’ll really need to pay for immediate shipping. There’s also a monthly subscription cost to use the platform.

EarnIn is actually a fintech company which offers credit rating monitoring and cash advance products which enable users to borrow nearly $750 for each spend period.

Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Mackenzie Rosman Then & Now!

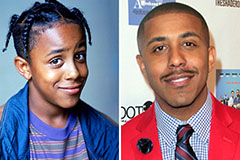

Mackenzie Rosman Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!